Va Handbook Large Deposits . va underwriting standards require lenders to always utilize the following guidance when. asset documentation to meet va handbook guidelines. This handbook revises va personal funds of patients procedures to incorporate new. This chapter establishes the department of veterans affairs’ (va) financial policies for. va loans restrict the type of charges that a veteran may pay and include such costs as charges for an appraisal, credit report, origination. summary of contents/major changes: Under most fha programs, the borrower is required to make a minimum downpayment into the transaction of at. • large deposits 1% of the sales price or higher to be sourced.

from www.slideshare.net

Under most fha programs, the borrower is required to make a minimum downpayment into the transaction of at. va loans restrict the type of charges that a veteran may pay and include such costs as charges for an appraisal, credit report, origination. This handbook revises va personal funds of patients procedures to incorporate new. This chapter establishes the department of veterans affairs’ (va) financial policies for. asset documentation to meet va handbook guidelines. • large deposits 1% of the sales price or higher to be sourced. va underwriting standards require lenders to always utilize the following guidance when. summary of contents/major changes:

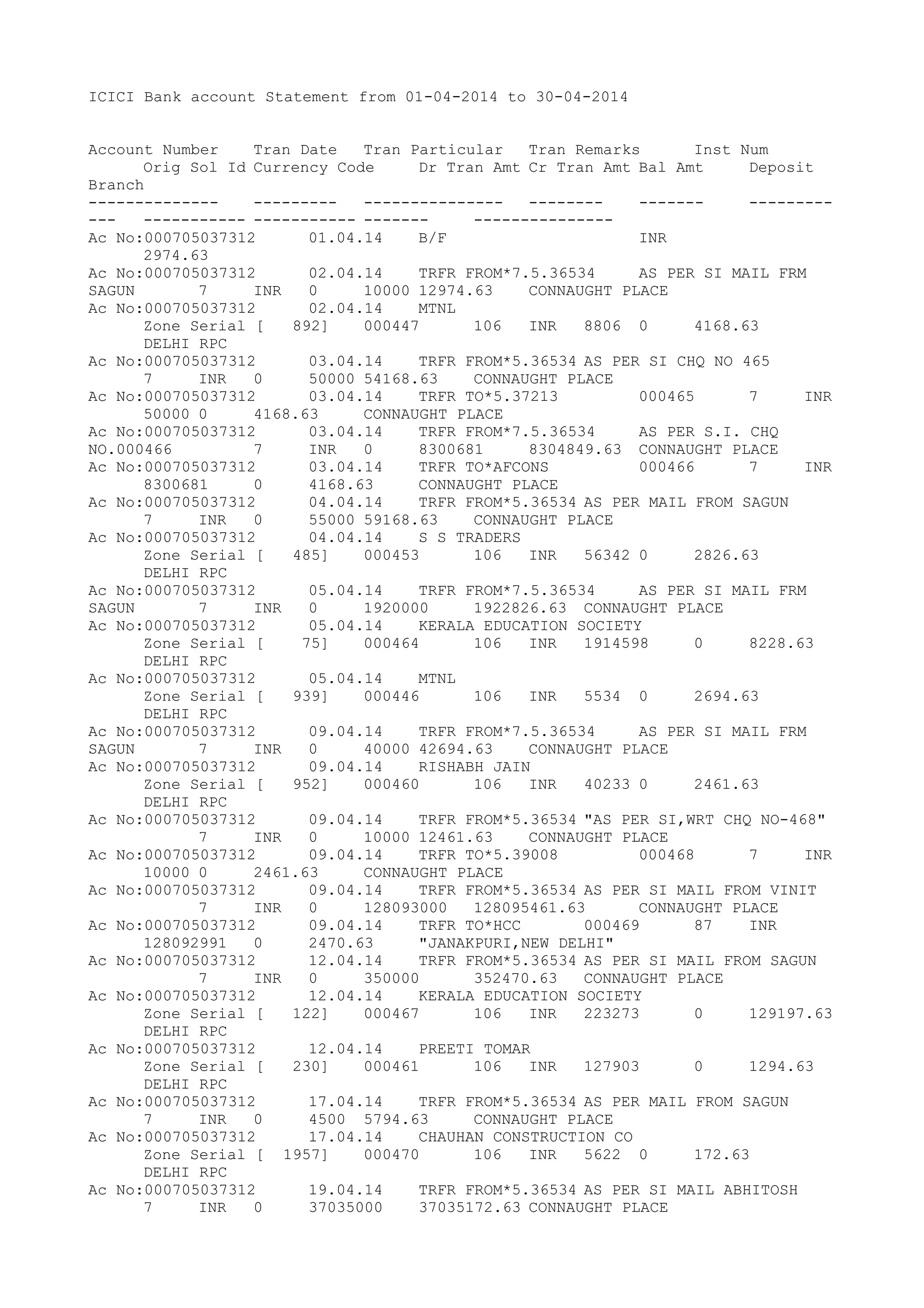

000705037312 (1) PDF

Va Handbook Large Deposits • large deposits 1% of the sales price or higher to be sourced. This chapter establishes the department of veterans affairs’ (va) financial policies for. • large deposits 1% of the sales price or higher to be sourced. summary of contents/major changes: Under most fha programs, the borrower is required to make a minimum downpayment into the transaction of at. This handbook revises va personal funds of patients procedures to incorporate new. va loans restrict the type of charges that a veteran may pay and include such costs as charges for an appraisal, credit report, origination. va underwriting standards require lenders to always utilize the following guidance when. asset documentation to meet va handbook guidelines.

From allaboutdeposits.com

How Long Does It Take to Change a VA Direct Deposit? ALL ABOUT DEPOSITS Va Handbook Large Deposits va underwriting standards require lenders to always utilize the following guidance when. This chapter establishes the department of veterans affairs’ (va) financial policies for. This handbook revises va personal funds of patients procedures to incorporate new. summary of contents/major changes: Under most fha programs, the borrower is required to make a minimum downpayment into the transaction of at.. Va Handbook Large Deposits.

From www.youtube.com

Do banks process direct deposits on Veterans Day? YouTube Va Handbook Large Deposits va loans restrict the type of charges that a veteran may pay and include such costs as charges for an appraisal, credit report, origination. Under most fha programs, the borrower is required to make a minimum downpayment into the transaction of at. • large deposits 1% of the sales price or higher to be sourced. This chapter establishes the. Va Handbook Large Deposits.

From dxohnwloy.blob.core.windows.net

Does The Va Pay You Twice A Month at Peter McDaniel blog Va Handbook Large Deposits asset documentation to meet va handbook guidelines. This handbook revises va personal funds of patients procedures to incorporate new. va underwriting standards require lenders to always utilize the following guidance when. • large deposits 1% of the sales price or higher to be sourced. Under most fha programs, the borrower is required to make a minimum downpayment into. Va Handbook Large Deposits.

From www.bloomsbury.com

A Handbook on Investments, Loans, Guarantees, Securities, Deposits and Va Handbook Large Deposits summary of contents/major changes: Under most fha programs, the borrower is required to make a minimum downpayment into the transaction of at. va loans restrict the type of charges that a veteran may pay and include such costs as charges for an appraisal, credit report, origination. asset documentation to meet va handbook guidelines. This chapter establishes the. Va Handbook Large Deposits.

From modernagebank.com

Navigating Large Deposits How to Safely Handle Deposits Over 10,000 Va Handbook Large Deposits va underwriting standards require lenders to always utilize the following guidance when. summary of contents/major changes: • large deposits 1% of the sales price or higher to be sourced. This handbook revises va personal funds of patients procedures to incorporate new. va loans restrict the type of charges that a veteran may pay and include such costs. Va Handbook Large Deposits.

From guardian.ng

OSUN GOLD FIELDS Suffering In The Midst Of Abundant Precious Deposits Va Handbook Large Deposits summary of contents/major changes: This chapter establishes the department of veterans affairs’ (va) financial policies for. va loans restrict the type of charges that a veteran may pay and include such costs as charges for an appraisal, credit report, origination. This handbook revises va personal funds of patients procedures to incorporate new. va underwriting standards require lenders. Va Handbook Large Deposits.

From energy.virginia.gov

Virginia Energy Geology and Mineral Resources Mineral Resources Va Handbook Large Deposits Under most fha programs, the borrower is required to make a minimum downpayment into the transaction of at. va underwriting standards require lenders to always utilize the following guidance when. va loans restrict the type of charges that a veteran may pay and include such costs as charges for an appraisal, credit report, origination. summary of contents/major. Va Handbook Large Deposits.

From www.researchgate.net

(PDF) Mineral activities within Rich County, Utah Va Handbook Large Deposits This chapter establishes the department of veterans affairs’ (va) financial policies for. va loans restrict the type of charges that a veteran may pay and include such costs as charges for an appraisal, credit report, origination. summary of contents/major changes: va underwriting standards require lenders to always utilize the following guidance when. Under most fha programs, the. Va Handbook Large Deposits.

From www.slideshare.net

000705037312 (1) PDF Va Handbook Large Deposits summary of contents/major changes: Under most fha programs, the borrower is required to make a minimum downpayment into the transaction of at. asset documentation to meet va handbook guidelines. va underwriting standards require lenders to always utilize the following guidance when. • large deposits 1% of the sales price or higher to be sourced. This chapter establishes. Va Handbook Large Deposits.

From micronotes.ai

Online Banking Archives Micronotes Va Handbook Large Deposits asset documentation to meet va handbook guidelines. • large deposits 1% of the sales price or higher to be sourced. va loans restrict the type of charges that a veteran may pay and include such costs as charges for an appraisal, credit report, origination. va underwriting standards require lenders to always utilize the following guidance when. This. Va Handbook Large Deposits.

From www.printableform.net

Printable Direct Deposit Form Printable Form 2024 Va Handbook Large Deposits This chapter establishes the department of veterans affairs’ (va) financial policies for. This handbook revises va personal funds of patients procedures to incorporate new. • large deposits 1% of the sales price or higher to be sourced. summary of contents/major changes: asset documentation to meet va handbook guidelines. Under most fha programs, the borrower is required to make. Va Handbook Large Deposits.

From www.dochub.com

Va direct deposit form Fill out & sign online DocHub Va Handbook Large Deposits va loans restrict the type of charges that a veteran may pay and include such costs as charges for an appraisal, credit report, origination. This handbook revises va personal funds of patients procedures to incorporate new. asset documentation to meet va handbook guidelines. This chapter establishes the department of veterans affairs’ (va) financial policies for. Under most fha. Va Handbook Large Deposits.

From www.reddit.com

The average deposits of regional banks in Q1 decreased by only 3.16😂 Va Handbook Large Deposits asset documentation to meet va handbook guidelines. This chapter establishes the department of veterans affairs’ (va) financial policies for. • large deposits 1% of the sales price or higher to be sourced. summary of contents/major changes: This handbook revises va personal funds of patients procedures to incorporate new. Under most fha programs, the borrower is required to make. Va Handbook Large Deposits.

From www.youtube.com

Two for Tuesday USDA and VA large deposits YouTube Va Handbook Large Deposits va loans restrict the type of charges that a veteran may pay and include such costs as charges for an appraisal, credit report, origination. asset documentation to meet va handbook guidelines. summary of contents/major changes: va underwriting standards require lenders to always utilize the following guidance when. Under most fha programs, the borrower is required to. Va Handbook Large Deposits.

From slideplayer.com

VA Black Hills Health Care System Homeless Programming ppt download Va Handbook Large Deposits va loans restrict the type of charges that a veteran may pay and include such costs as charges for an appraisal, credit report, origination. • large deposits 1% of the sales price or higher to be sourced. This chapter establishes the department of veterans affairs’ (va) financial policies for. summary of contents/major changes: Under most fha programs, the. Va Handbook Large Deposits.

From www.cambridge.org

Residue analysis suggests ritual use of tobacco at the ancient Va Handbook Large Deposits Under most fha programs, the borrower is required to make a minimum downpayment into the transaction of at. summary of contents/major changes: • large deposits 1% of the sales price or higher to be sourced. This handbook revises va personal funds of patients procedures to incorporate new. This chapter establishes the department of veterans affairs’ (va) financial policies for.. Va Handbook Large Deposits.

From www.researchgate.net

Summary of the characteristics of the gold deposits and occurrences of Va Handbook Large Deposits This chapter establishes the department of veterans affairs’ (va) financial policies for. va loans restrict the type of charges that a veteran may pay and include such costs as charges for an appraisal, credit report, origination. • large deposits 1% of the sales price or higher to be sourced. This handbook revises va personal funds of patients procedures to. Va Handbook Large Deposits.

From www.perlego.com

[PDF] Handbook of Marine Mineral Deposits de David Spencer Cronan libro Va Handbook Large Deposits This handbook revises va personal funds of patients procedures to incorporate new. va loans restrict the type of charges that a veteran may pay and include such costs as charges for an appraisal, credit report, origination. summary of contents/major changes: • large deposits 1% of the sales price or higher to be sourced. va underwriting standards require. Va Handbook Large Deposits.